Bitcoin flirts with $69,000 as Uptober Gets Into Gear

Bitcoin has ended the week strong, surging to almost $69,000 but has remained in the same range since March. Will this be the month for a breakout to new ATHs?

We’re not there yet but the stars might finally be aligning for Bitcoin. Bitcoin started the week with a Chinese stimulus-driven rally, hitting $66,500 before pulling back slightly. On Tuesday Bitcoin pushed again taking traders on a wild ride, forming an “upside-down V” pattern. Late Friday Bitcoin surged to $68,900 flirting with $69,000, a three-month high.

Source: BNC Bitcoin Liquid Index

This month’s momentum is positive, however, the yearly chart clearly shows Bitcoin has been range bound since March, when it first broke out following the launch of the spot ETFs. The key will be for Bitcoin to push on above $70,000 for a bull market to ignite.

Source: BNC Bitcoin Liquid Index

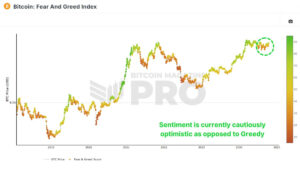

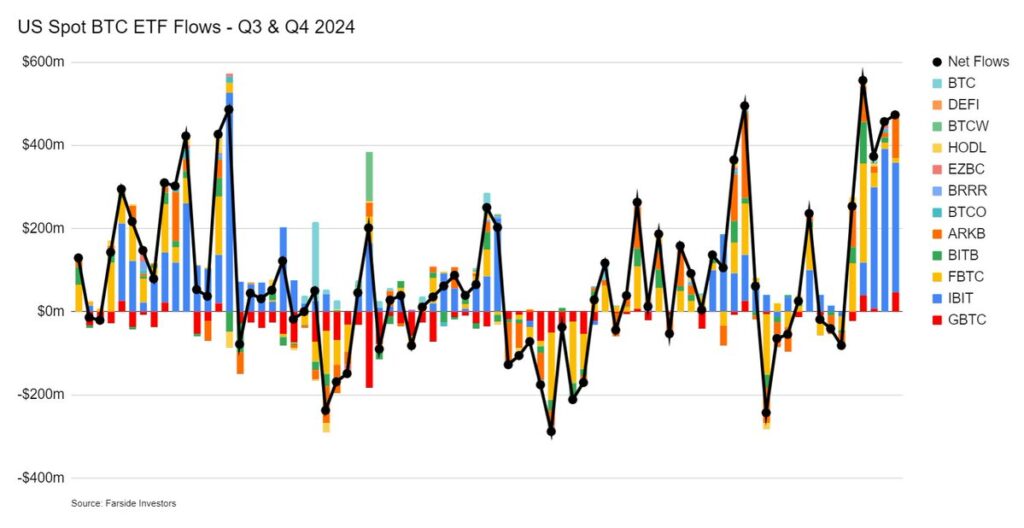

This Was a Monster ETF Week

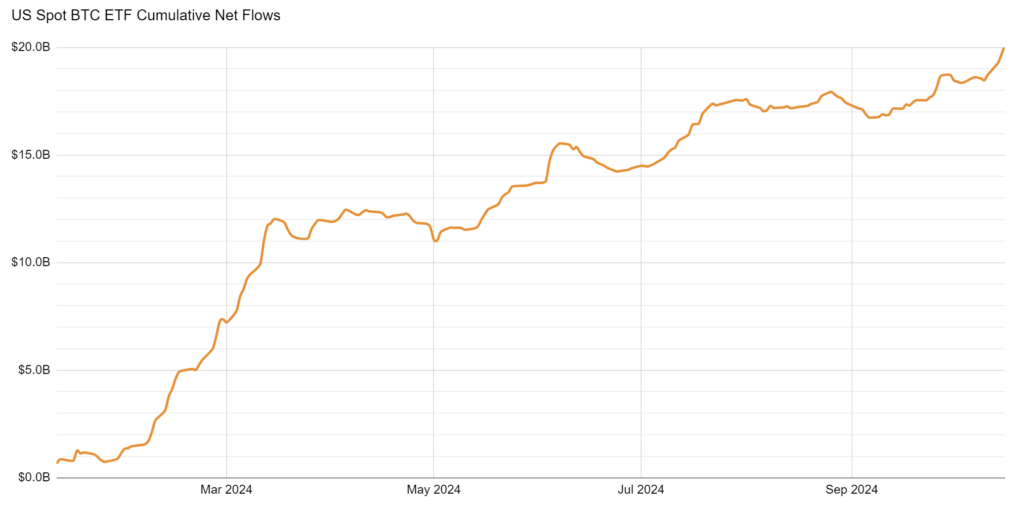

Spot Bitcoin ETFs have recorded four straight days of inflows, bringing their total cumulative flows to over $20 billion since launching in January.

Cumulative net inflows into spot Bitcoin ETFs have surpassed $20 billion since their launch earlier this year. It took gold ETFs 5 years to reach this figure. That makes the Bitcoin ETFs the most successful debut of any ETF in history.

Eric Balchunas, Senior ETF Analyst for Bloomberg wrote on X that “Bitcoin ETFs have crossed $20b in total net flows (the most imp number, most difficult metric to grow in ETF world) for the first time after huge week of $1.5b. For context, it took gold ETFs about 5 years to reach the same number. Total assets now $65b, also a high water mark.”

Source: FarSide Investors

Source: X

The Market Likes Trump

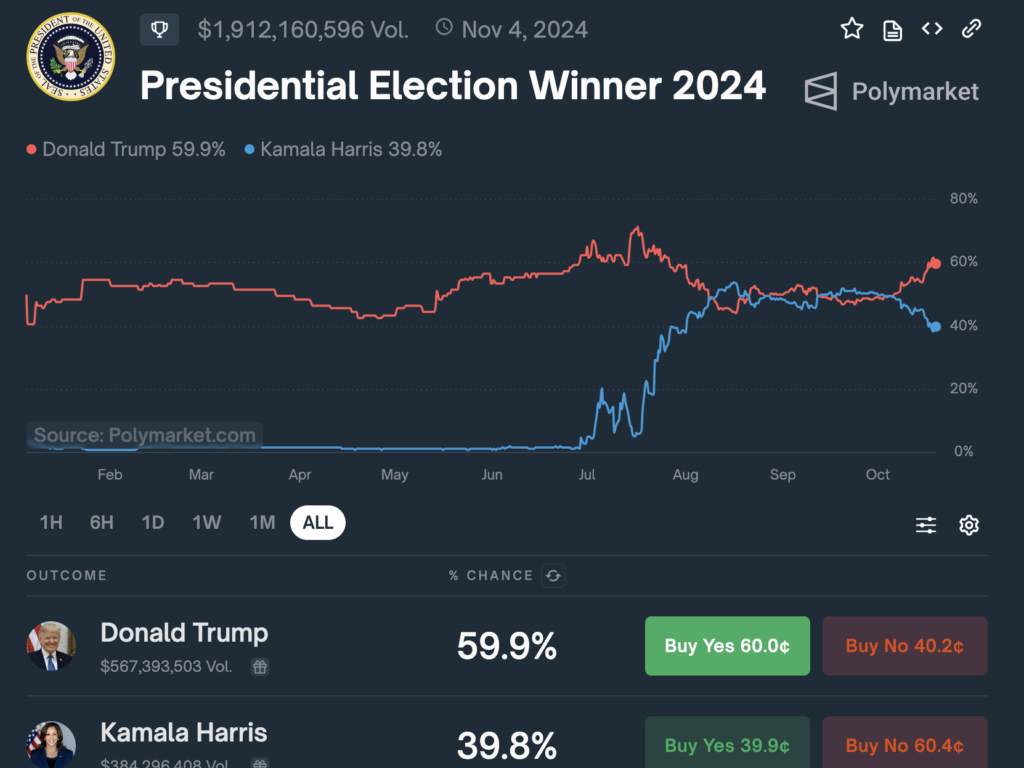

Bitcoin is up 7.6% over the past week, the surge has been influenced by the rising momentum of pro-crypto Republican presidential candidate Donald Trump, according to analysts. Polymarket gives Trump a 56% chance of winning the upcoming election, which is driving crypto optimism. Analysts from QCP Capital believe the surge was partly election-driven, citing Trump’s rise in the polls and a more favorable stance on crypto regulation from Democratic candidate Kamala Harris.

Source: Polymarket

Larry Fink, CEO at BlackRock had a similar view poo-pooing the idea that the U.S. election would change the trajectory of Bitcoin. “I’m not sure if either president would make a difference,” Fink remarked, predicting that broader market dynamics, rather than election results, would shape Bitcoin’s future. His comments echo a bullish prediction from Standard Chartered, which projects Bitcoin moving up to $200,000 by 2025 regardless of who is in government.

BlackRock CEO Larry Fink Declares Bitcoin a Standalone Asset Class

BlackRock CEO Larry Fink has declared that Bitcoin is an asset class in its own right, likening it to commodities such as gold.

Fink shared these views during BlackRock’s Q3 2024 earnings call, underscoring Bitcoin’s growing relevance in the institutional investment space.

With BlackRock’s Bitcoin exchange-traded fund (ETF) reaching $20 billion in inflows, Fink’s remarks highlight a growing trend: major financial players are no longer just dabbling in digital assets—they’re actively incorporating them into their portfolios. Fink emphasized, “We believe Bitcoin is an asset class in itself. It is an alternative to other commodities like gold.” This statement from the CEO of the $11.5 trillion asset manager signals a dramatic shift in how the cryptocurrency is viewed by traditional finance.

Fink’s comments come at a time when Bitcoin’s market capitalization stands at $1.3 trillion, dwarfed by the US housing market’s $49.6 trillion valuation, but growing fast. His bullish stance is a reversal from 2021, when he shared skepticism toward cryptocurrencies alongside JPMorgan’s Jamie Dimon. Now, Fink sees a future where Bitcoin, and digital assets more broadly, become entrenched parts of the global financial system.

Fink didn’t stop at Bitcoin. He elaborated on the future of blockchain technology and digital assets, forecasting their transformative impact on global finance. He downplayed the potential influence of regulatory shifts, arguing that widespread adoption and enhanced liquidity would drive growth in the space. “I truly don’t believe it’s a function of more regulation or less regulation. I think it’s a function of liquidity, transparency…no different than years ago when we started the mortgage market,” Fink remarked.

Highlighting the success of BlackRock’s Ethereum ETF, which attracted over $1 billion in net inflows in just two months, Fink reaffirmed the firm’s commitment to digital innovation. “We will continue to pioneer new products to make investing easier and more affordable,” he said, hinting at BlackRock’s ambition to push the boundaries of traditional asset management through blockchain and crypto.

Time to Think Bigger

Hunter Horsley, CEO AT Bitwise, has urged the crypto community to shift focus from short-term, price-centric goals to broader, long-term visions.

Instead of obsessing over Bitcoin’s price or coin comparisons, Horsley challenges people to think about what needs to happen for Bitcoin to overtake gold in value, or how blockchain applications can disrupt traditional industries in the coming years.

He advocates for ambitious thinking and transformative growth, quoting T.S. Eliot: “Only those who risk going too far can possibly find out how far they can go,” emphasizing bold risk-taking for future success.

Source: X

Horsley also predicted that “25-50% of wealth managers will have 1-5% allocated to Bitcoin in the next 24 months. In the US, wealth manages ~$30T. He said, “I think Endowments probably need another 6-12 months to be interested in buying spot exposure again. They’re busy and have exposure re venture. There will be a few pensions here and there but I expect them to start looking, acting in 12-36mo.”

Welcome to Uptober

Generally speaking, Bitcoin seasonality means October is usually a bullish month for Bitcoin and the Crypto markets.

Source: X

- October usually ends in the green, and it’s not uncommon for the month to start with a dip. In 2023, Bitcoin lost 7% in the first half of the month before jumping by 32%

- October 2024 saw a 5% dip due to global tensions, and we’ve just had a mid-month recovery.

- Interest rate cuts by the Federal Reserve have in the past been a boon to crypto prices due to increased liquidity and better borrowing conditions.

- In 2024, more rate cuts are on the table, contributing to positive sentiment, which could fuel a late-month rally in Bitcoin.

#Bitcoin #flirts #Uptober #Gear

News plays a pivotal role in our lives by keeping us informed and connected to the world. It serves as a critical source of information, offering updates on current events, politics, economics, science, and more. Through news, we gain awareness of global issues and local developments, helping us make informed decisions in our personal and professional lives. News also fosters discussion and debate, encouraging critical thinking and perspective-taking. Moreover, it promotes transparency and accountability among governments, businesses, and other institutions. In a rapidly changing world, staying updated with the news enables us to adapt to new challenges and opportunities, shaping our understanding of the complexities of society. Ultimately, news is not just about information; it empowers us to participate actively in the world around us, contributing to a more informed, engaged, and responsible global citizenry.

Health is fundamental to our well-being and quality of life, making it an essential aspect of daily existence. It encompasses physical, mental, and emotional aspects, influencing our ability to function effectively and enjoy life fully. Prioritizing health allows individuals to maintain optimal physical fitness, reducing the risk of diseases and promoting longevity. Mental health, equally crucial, affects our cognitive abilities, emotional stability, and overall happiness. Investing in preventive healthcare through exercise, balanced nutrition, and regular medical check-ups helps in early detection of potential health issues, ensuring timely intervention and treatment. Beyond individual benefits, a population’s health impacts societal productivity and economic stability. Governments and organizations worldwide emphasize public health initiatives to address pandemics, health disparities, and promote overall well-being. Ultimately, health serves as the foundation upon which we build our lives, influencing our ability to pursue goals, nurture relationships, and contribute meaningfully to society.

Money plays a crucial role in our lives as a means of financial security and freedom. It enables us to meet basic needs such as food, shelter, and healthcare, while also providing opportunities for education, travel, and personal growth. Beyond material comforts, money facilitates social connections and experiences that enrich our lives. It empowers individuals to invest in their futures, whether through savings, investments, or entrepreneurial ventures, thereby fostering economic stability and growth. However, the pursuit of wealth should also be balanced with ethical considerations, as money can influence relationships and societal dynamics. Responsible management of finances is key to achieving long-term goals and mitigating financial stress. Ultimately, while money is a tool for achieving aspirations and fulfilling desires, its true value lies in how it is utilized to improve both personal well-being and the broader community.

Earning Easy Money in 2024: Opportunities and Considerations 💸

In 2024, the landscape of earning easy money presents diverse opportunities, albeit with considerations. The digital age offers platforms for freelancing, online trading, and e-commerce, allowing individuals to leverage skills and creativity for financial gain. Cryptocurrency investments continue to allure with potential for quick profits, yet they entail high volatility and risk. Moreover, the rise of the gig economy enables flexible work arrangements through apps and websites, offering quick payouts but often without job security or benefits. Passive income streams such as rental properties and investments in stocks or bonds remain viable, but demand initial capital and ongoing management. Amid these options, caution is essential to avoid scams and unsustainable ventures promising overnight success. Ultimately, while the allure of easy money persists, informed decisions, diligence, and a long-term perspective are crucial for sustainable financial growth and security in the dynamic year ahead.