BitClave Investors Recover $4.6 Million In SEC Settlement Payout

The checks for BitClave investors are now in the mail. With this short post on Twitter/X by the Securities and Exchange Commission (SEC), investors of the controversial 2017 ICO offering can now start collecting what is rightfully theirs. The $4.6 million check is for investors in BitClave’s 2017 ICO offering with unregistered digital assets securities.

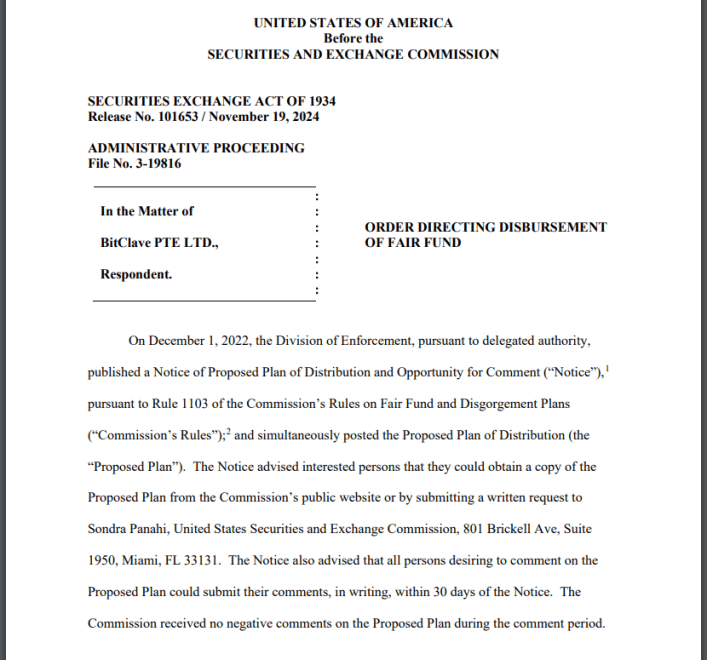

This approved settlement amount was agreed upon in 2020, and it’s only this November 20th that the agency has confirmed the availability of funds. After the standard Notice & Claims process, the qualified investors can now receive their portion of the BitClave Fair Fund.

The checks are in the mail. We are sending out more than $4.6M to investors harmed by BitClave, PTE Ltd.’s unregistered ICO of digital asset securities. After a notice & claims process, investors will now be receiving their share of the BitClave Fair Fund. https://t.co/VSmrObLZUa pic.twitter.com/zUdHRkAoS2

— U.S. Securities and Exchange Commission (@SECGov) November 20, 2024

SEC Approves $4.6 Million Fund As Part Of Settlement

According to document Release No. 101653, published on November 19, 2024, BitClave’s investors were paid out the $4.6 million amount. This document notes that the agency has set aside $4,614,679.81 to assist the affected investors.

The settlement fund shall be sourced from the Fair Fund and transferred to its escrow account at the Huntington National Bank, N.A., for disposition and distribution. According to the SEC, the checks are now in transit, and funds will become available after the Notice & Claims procedures.

An ICO With Unregistered Securities

BitClave’s ICO in 2017 generated a lot of attention and excitement, raising $25.5 million in 32 seconds. The subject of the ICO was the Consumer Activity Token (CAT), which was later classified as an unregistered security. According to the SEC, thousands of investors were encouraged to invest in the tokens with the expectation that they would increase in price.

Image: Bloomingbit

Under the settlement’s rules, the company will refund the raised money and pay $4 million in interest and fines. During the settlement process, John Deaton accused the SEC of relying on laws introduced in 1933.

As a result, the agency established the Fair Fund to ensure that the affected investors will get their share of the proceeds. The SEC initiated the claims submission, with the filing ending in August 2023. The eligible investors received their notices in March 2024.

BitClave Asked To Destroy Tokens, Pay Penalties

BitClave pledged to give back $29 million as part of the settlement, comprising fines of $4 million and the $25.5 million raised during the ICO. The firm has also called on crypto exchanges to delist all unissued coins and promises to burn them.

In February 2024, the SEC reported that the crypto industry forwarded only $12 million to the Fair Fund but left $7.4 million in uncertainty because it failed to forward that amount. The agency and the fund administrator didn’t provide additional comments on the method through which the remaining funds will be collected.

Featured image from DALL-E, chart from TradingView

#BitClave #Investors #Recover #Million #SEC #Settlement #Payout

News plays a pivotal role in our lives by keeping us informed and connected to the world. It serves as a critical source of information, offering updates on current events, politics, economics, science, and more. Through news, we gain awareness of global issues and local developments, helping us make informed decisions in our personal and professional lives. News also fosters discussion and debate, encouraging critical thinking and perspective-taking. Moreover, it promotes transparency and accountability among governments, businesses, and other institutions. In a rapidly changing world, staying updated with the news enables us to adapt to new challenges and opportunities, shaping our understanding of the complexities of society. Ultimately, news is not just about information; it empowers us to participate actively in the world around us, contributing to a more informed, engaged, and responsible global citizenry.

Health is fundamental to our well-being and quality of life, making it an essential aspect of daily existence. It encompasses physical, mental, and emotional aspects, influencing our ability to function effectively and enjoy life fully. Prioritizing health allows individuals to maintain optimal physical fitness, reducing the risk of diseases and promoting longevity. Mental health, equally crucial, affects our cognitive abilities, emotional stability, and overall happiness. Investing in preventive healthcare through exercise, balanced nutrition, and regular medical check-ups helps in early detection of potential health issues, ensuring timely intervention and treatment. Beyond individual benefits, a population’s health impacts societal productivity and economic stability. Governments and organizations worldwide emphasize public health initiatives to address pandemics, health disparities, and promote overall well-being. Ultimately, health serves as the foundation upon which we build our lives, influencing our ability to pursue goals, nurture relationships, and contribute meaningfully to society.

Money plays a crucial role in our lives as a means of financial security and freedom. It enables us to meet basic needs such as food, shelter, and healthcare, while also providing opportunities for education, travel, and personal growth. Beyond material comforts, money facilitates social connections and experiences that enrich our lives. It empowers individuals to invest in their futures, whether through savings, investments, or entrepreneurial ventures, thereby fostering economic stability and growth. However, the pursuit of wealth should also be balanced with ethical considerations, as money can influence relationships and societal dynamics. Responsible management of finances is key to achieving long-term goals and mitigating financial stress. Ultimately, while money is a tool for achieving aspirations and fulfilling desires, its true value lies in how it is utilized to improve both personal well-being and the broader community.

Earning Easy Money in 2024: Opportunities and Considerations 💸

In 2024, the landscape of earning easy money presents diverse opportunities, albeit with considerations. The digital age offers platforms for freelancing, online trading, and e-commerce, allowing individuals to leverage skills and creativity for financial gain. Cryptocurrency investments continue to allure with potential for quick profits, yet they entail high volatility and risk. Moreover, the rise of the gig economy enables flexible work arrangements through apps and websites, offering quick payouts but often without job security or benefits. Passive income streams such as rental properties and investments in stocks or bonds remain viable, but demand initial capital and ongoing management. Amid these options, caution is essential to avoid scams and unsustainable ventures promising overnight success. Ultimately, while the allure of easy money persists, informed decisions, diligence, and a long-term perspective are crucial for sustainable financial growth and security in the dynamic year ahead.