Bitcoin ETFs hit $21 billion net inflows as weekly purchases top $2 billion

Key Takeaways

- Bitcoin ETFs reached a total of $21 billion in net inflows, a record high.

- ARKB and IBIT were the top performers, significantly contributing to the week’s gains.

Share this article

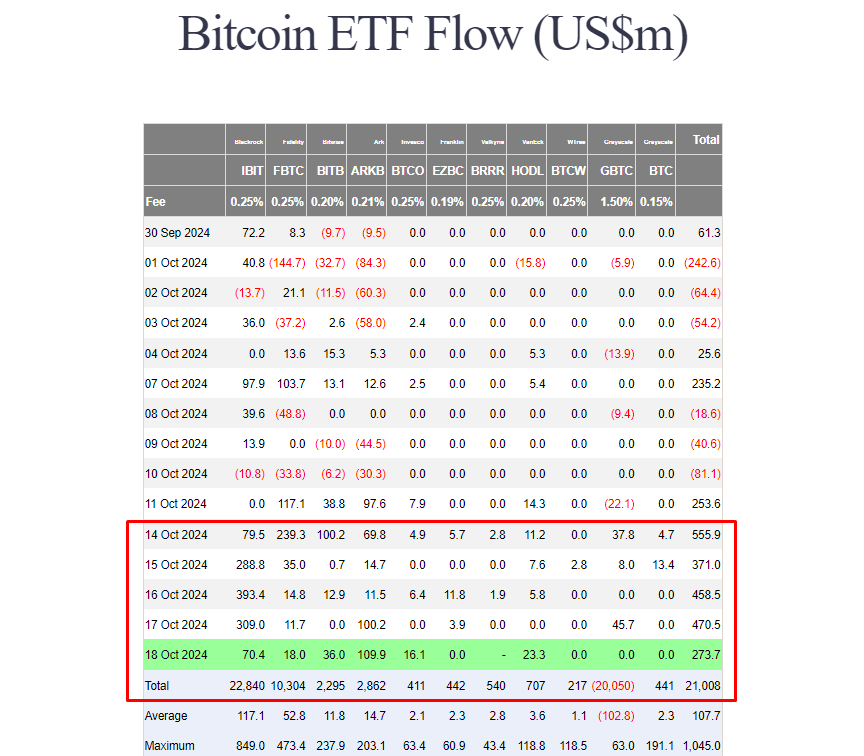

US spot Bitcoin ETFs reached $21 billion in total net inflows on Friday as investor appetite for these funds remains strong. According to data from Farside Investors, these ETFs collectively netted over $2 billion this week, extending their winning streak to six consecutive days.

Yesterday alone, spot Bitcoin ETFs, excluding Valkyrie’s BRRR, attracted around $273 million in net purchases. ARK Invest’s ARKB led the group with nearly $110 million.

BlackRock’s IBIT also logged over $70 million in net inflows on Friday, followed by VanEck’s HODL, Bitwise’s BITB, Fidelity’s FBTC, and Invesco’s BTCO.

IBIT and ARKB were the top-performing Bitcoin ETFs this week. ARKB experienced a surge in inflows, surpassing $100 million on both Thursday and Friday.

Meanwhile, half of the group’s inflows came from IBIT. As of October 18, its net inflows have topped $23 billion, solidifying its position as the world’s premier Bitcoin ETF.

With Friday’s positive performance, Bitcoin ETFs saw their first week with no negative inflows. Even Grayscale’s GBTC, known for its historical outflow reputation, reversed the trend with over $91 million in net inflows.

Bitcoin ETF options to deepen liquidity and bring in more investors

On Friday, the SEC approved NYSE and CBOE’s proposals to list options for spot Bitcoin ETFs. While the exact launch date has yet to be determined, ETF experts say the approval will expand market access to crypto-related financial products on major US exchanges.

Nate Geraci, president of the ETF Store, sees options trading on spot Bitcoin ETFs will increase liquidity around Bitcoin ETFs, attract more players to the market, and thus make the whole ecosystem more robust.

“In terms of the potential impact here, I think that options trading on spot Bitcoin ETFs is decidedly good. Because all options trading is going to do is deepen the liquidity around spot Bitcoin ETFs,” said Geraci, speaking in a recent episode of Thinking Crypto. “It’s going to bring more players into the space, I would say especially institutional players. To me, it just makes the entire spot Bitcoin ETF ecosystem that much more robust.”

According to Geraci, options trading is important for institutional investors in hedging and implementing complex strategies, especially with a volatile asset like Bitcoin.

The ETF expert suggests that retail investors, in addition to institutional players, are eager to access options trading for the same reasons.

“Even when we look over to the retail side, with more sophisticated retail investors, they want options trading as well for the same reason,” Geraci stated.

Share this article

#Bitcoin #ETFs #hit #billion #net #inflows #weekly #purchases #top #billion

News plays a pivotal role in our lives by keeping us informed and connected to the world. It serves as a critical source of information, offering updates on current events, politics, economics, science, and more. Through news, we gain awareness of global issues and local developments, helping us make informed decisions in our personal and professional lives. News also fosters discussion and debate, encouraging critical thinking and perspective-taking. Moreover, it promotes transparency and accountability among governments, businesses, and other institutions. In a rapidly changing world, staying updated with the news enables us to adapt to new challenges and opportunities, shaping our understanding of the complexities of society. Ultimately, news is not just about information; it empowers us to participate actively in the world around us, contributing to a more informed, engaged, and responsible global citizenry.

Health is fundamental to our well-being and quality of life, making it an essential aspect of daily existence. It encompasses physical, mental, and emotional aspects, influencing our ability to function effectively and enjoy life fully. Prioritizing health allows individuals to maintain optimal physical fitness, reducing the risk of diseases and promoting longevity. Mental health, equally crucial, affects our cognitive abilities, emotional stability, and overall happiness. Investing in preventive healthcare through exercise, balanced nutrition, and regular medical check-ups helps in early detection of potential health issues, ensuring timely intervention and treatment. Beyond individual benefits, a population’s health impacts societal productivity and economic stability. Governments and organizations worldwide emphasize public health initiatives to address pandemics, health disparities, and promote overall well-being. Ultimately, health serves as the foundation upon which we build our lives, influencing our ability to pursue goals, nurture relationships, and contribute meaningfully to society.

Money plays a crucial role in our lives as a means of financial security and freedom. It enables us to meet basic needs such as food, shelter, and healthcare, while also providing opportunities for education, travel, and personal growth. Beyond material comforts, money facilitates social connections and experiences that enrich our lives. It empowers individuals to invest in their futures, whether through savings, investments, or entrepreneurial ventures, thereby fostering economic stability and growth. However, the pursuit of wealth should also be balanced with ethical considerations, as money can influence relationships and societal dynamics. Responsible management of finances is key to achieving long-term goals and mitigating financial stress. Ultimately, while money is a tool for achieving aspirations and fulfilling desires, its true value lies in how it is utilized to improve both personal well-being and the broader community.

Earning Easy Money in 2024: Opportunities and Considerations 💸

In 2024, the landscape of earning easy money presents diverse opportunities, albeit with considerations. The digital age offers platforms for freelancing, online trading, and e-commerce, allowing individuals to leverage skills and creativity for financial gain. Cryptocurrency investments continue to allure with potential for quick profits, yet they entail high volatility and risk. Moreover, the rise of the gig economy enables flexible work arrangements through apps and websites, offering quick payouts but often without job security or benefits. Passive income streams such as rental properties and investments in stocks or bonds remain viable, but demand initial capital and ongoing management. Amid these options, caution is essential to avoid scams and unsustainable ventures promising overnight success. Ultimately, while the allure of easy money persists, informed decisions, diligence, and a long-term perspective are crucial for sustainable financial growth and security in the dynamic year ahead.