Can Bitcoin Now Make A New All-Time High

Bitcoin has been steadily climbing since crossing the $60,000 mark and is currently hovering closer to the $70,000 level, a price it hasn’t reached in months. With the market sentiment heating up, investors are wondering whether Bitcoin has the strength to reach new all-time highs or if it will struggle to break past key resistance levels.

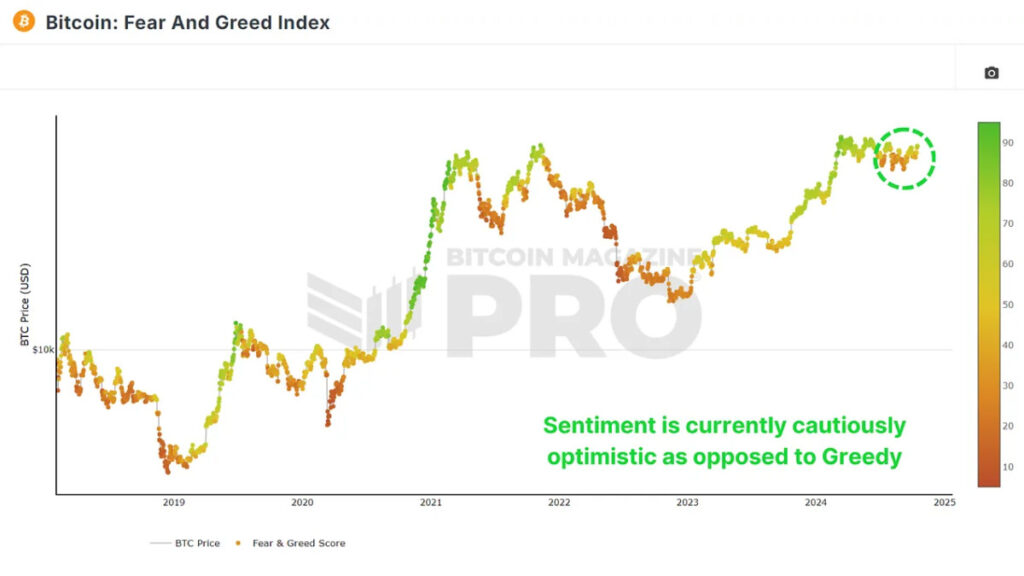

A Healthy Sentiment

The Fear and Greed Index is a useful tool for understanding market sentiment and how traders view the trajectory of Bitcoin. Currently, the index is at a “Greed” level of around 70, which is historically seen as a positive sign but still a fair distance from the extreme greed levels that could indicate a potential market top. This index measures emotions in the market, with lower levels indicating fear and higher levels suggesting greed. Typically, when the index surpasses the 90+ range, the market becomes overly bullish, raising concerns of overextension.

It’s important to note that last year, when the Fear and Greed Index reached similar levels, Bitcoin was trading at around $34,000. From there, it more than doubled to $73,000 over the following months.

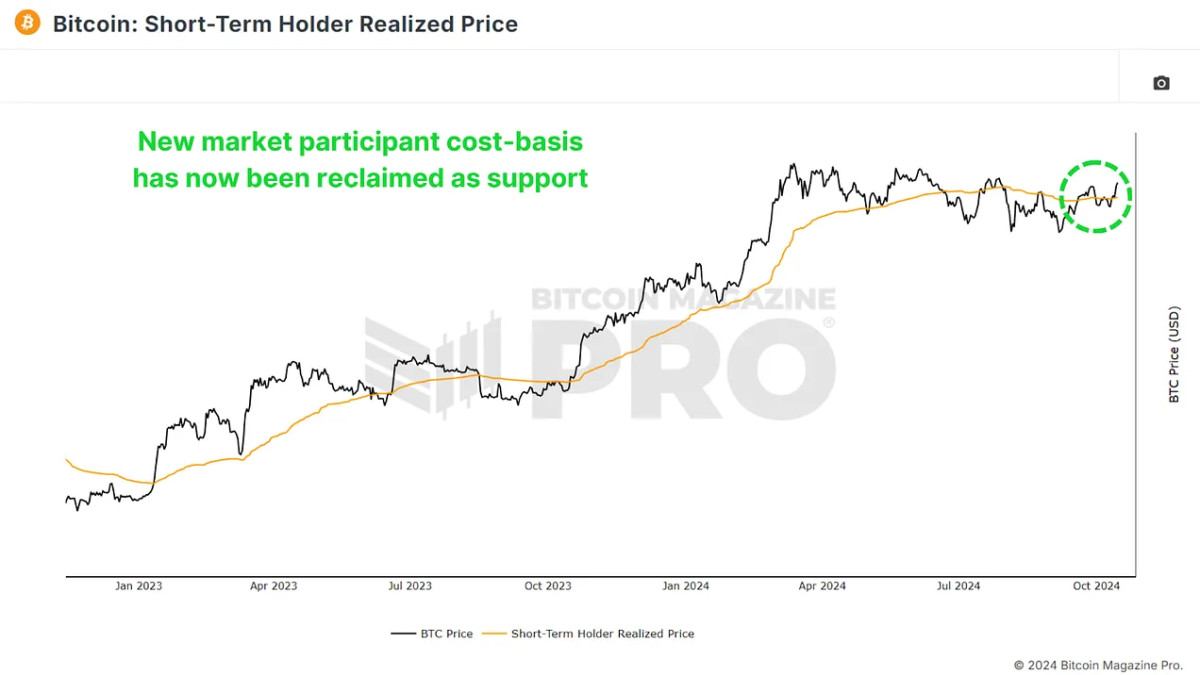

Key Support

The Short-Term Holder Realized Price measures the average price new Bitcoin investors have paid for their bitcoin. It’s crucial because it often acts as a strong support level during bull markets and as resistance during bear markets. Currently, this price sits around $62,000, and Bitcoin has managed to stay above it. This is a promising sign, as it shows that newer market participants are in profit, and Bitcoin is holding above a crucial support zone. Historically, breaking below this level has led to market weakness, so maintaining this support is key to any continued rally.

We’ve seen this dynamic in past cycles, especially during the 2016-2017 bull market, where Bitcoin retraced to this level several times before continuing its climb. If this trend holds, Bitcoin’s recent breakthrough could provide a foundation for further gains.

Stabilizing Market

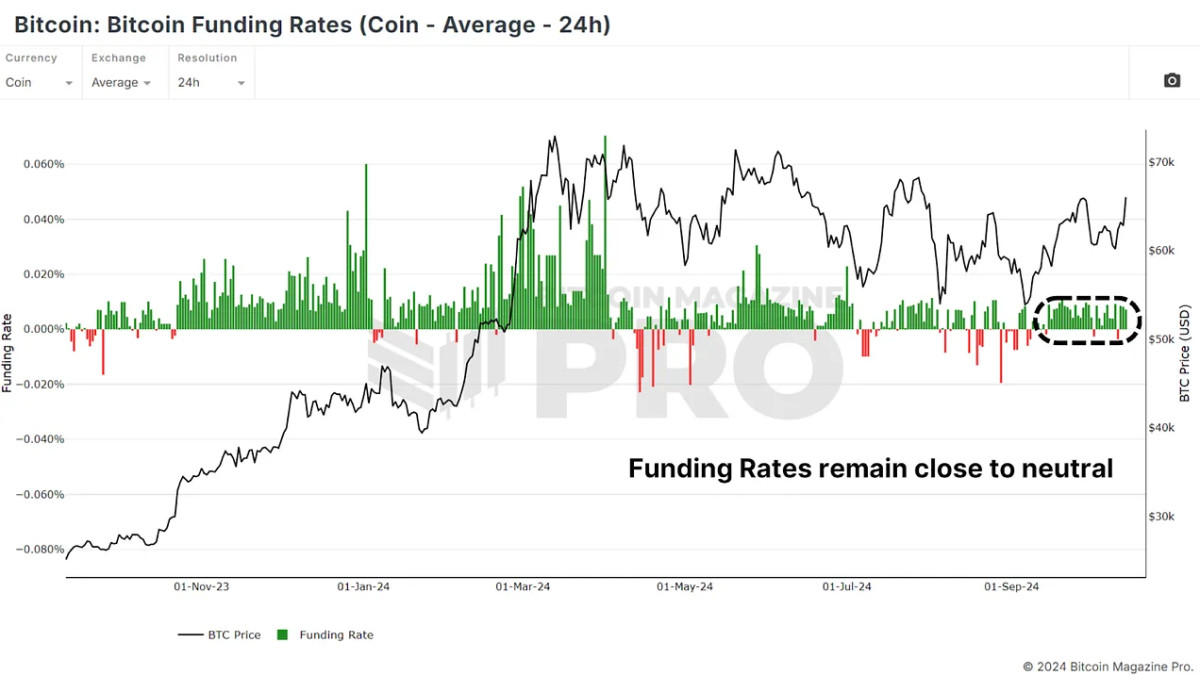

One area that traders often watch is Funding Rates, which indicate the cost of holding long or short positions in Bitcoin futures. Over the past few months, funding rates have been volatile, swinging between overly optimistic long positions and overly bearish short positions. Thankfully, the market has now stabilized, with funding rates sitting at neutral levels. This is a healthy sign as it suggests traders aren’t overly leveraged in either direction.

In neutral territory, there’s less risk of a liquidation cascade, a common phenomenon when over-leveraged positions get wiped out, causing sharp market drops. As long as the funding rates remain stable, Bitcoin could have the breathing room it needs to continue rising without major volatility.

A Tough Path to $70,000 and Beyond

While the market sentiment and technicals suggest that Bitcoin is in a healthy place, there are still significant levels of resistance above. First, the current resistance trend line is one that Bitcoin has struggled to break. This downtrend line has been tested several times, but each time, Bitcoin has retraced after hitting it.

Beyond this, Bitcoin faces several additional barriers, such as $70,000. This level has acted as resistance in the past and represents a psychological level that traders will likely be watching closely. And above that the all-time high between $73,000 and $74,000. Breaking this would be a major bullish signal, but it could take several attempts before Bitcoin clears this level.

One positive technical element is the recent reclaim of the 200 daily moving average. A key level for investors to watch that had acted as resistance for BTC over the previous few months.

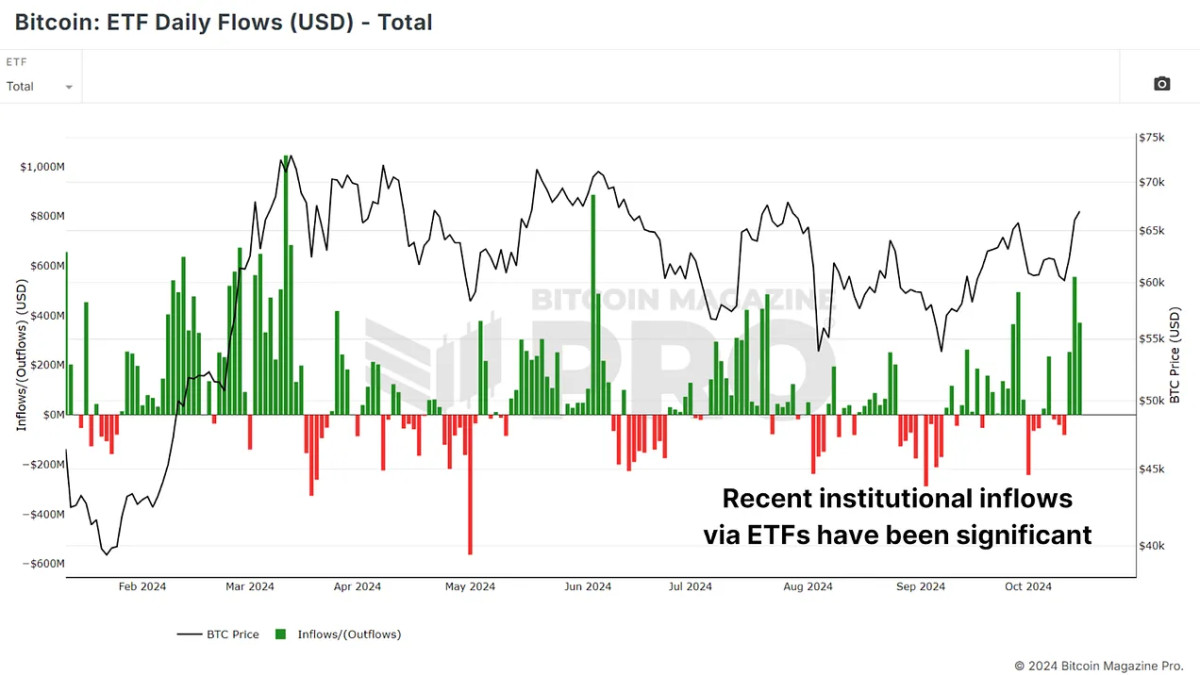

The Macro Environment: Institutional and ETF Inflows

Beyond technical indicators, the macro environment is increasingly favorable for Bitcoin. Institutional money continues to flow into Bitcoin Exchange-Traded Funds (ETFs). In the past few days, over $1 billion has flowed into Bitcoin ETFs, reflecting growing confidence in the asset. Over the past few weeks, we’ve seen hundreds of millions more in ETF inflows, signaling that smart money, particularly institutional investors, is bullish on Bitcoin’s future.

This is significant because institutional money tends to take a long-term view, providing a more stable base of support than retail speculation. Moreover, as equities and even gold have been gaining ground in recent months, Bitcoin appears to be lagging slightly behind. This could set the stage for Bitcoin to play catch-up, particularly if investors rotate from traditional assets into the more risk-on realm of Bitcoin.

Conclusion

Bitcoin’s price action, funding rates, and sentiment all suggest that the market is in a healthier place than it has been in months. Institutional inflows into ETFs and improving macro conditions add further bullish tailwinds. However, significant resistance lies ahead, and any rally will likely face challenges before Bitcoin can truly break out to new highs.

For a more in-depth look into this topic, check out a recent YouTube video here:

Can Bitcoin Now Make A New ATH

#Bitcoin #AllTime #High

News plays a pivotal role in our lives by keeping us informed and connected to the world. It serves as a critical source of information, offering updates on current events, politics, economics, science, and more. Through news, we gain awareness of global issues and local developments, helping us make informed decisions in our personal and professional lives. News also fosters discussion and debate, encouraging critical thinking and perspective-taking. Moreover, it promotes transparency and accountability among governments, businesses, and other institutions. In a rapidly changing world, staying updated with the news enables us to adapt to new challenges and opportunities, shaping our understanding of the complexities of society. Ultimately, news is not just about information; it empowers us to participate actively in the world around us, contributing to a more informed, engaged, and responsible global citizenry.

Health is fundamental to our well-being and quality of life, making it an essential aspect of daily existence. It encompasses physical, mental, and emotional aspects, influencing our ability to function effectively and enjoy life fully. Prioritizing health allows individuals to maintain optimal physical fitness, reducing the risk of diseases and promoting longevity. Mental health, equally crucial, affects our cognitive abilities, emotional stability, and overall happiness. Investing in preventive healthcare through exercise, balanced nutrition, and regular medical check-ups helps in early detection of potential health issues, ensuring timely intervention and treatment. Beyond individual benefits, a population’s health impacts societal productivity and economic stability. Governments and organizations worldwide emphasize public health initiatives to address pandemics, health disparities, and promote overall well-being. Ultimately, health serves as the foundation upon which we build our lives, influencing our ability to pursue goals, nurture relationships, and contribute meaningfully to society.

Money plays a crucial role in our lives as a means of financial security and freedom. It enables us to meet basic needs such as food, shelter, and healthcare, while also providing opportunities for education, travel, and personal growth. Beyond material comforts, money facilitates social connections and experiences that enrich our lives. It empowers individuals to invest in their futures, whether through savings, investments, or entrepreneurial ventures, thereby fostering economic stability and growth. However, the pursuit of wealth should also be balanced with ethical considerations, as money can influence relationships and societal dynamics. Responsible management of finances is key to achieving long-term goals and mitigating financial stress. Ultimately, while money is a tool for achieving aspirations and fulfilling desires, its true value lies in how it is utilized to improve both personal well-being and the broader community.

Earning Easy Money in 2024: Opportunities and Considerations 💸

In 2024, the landscape of earning easy money presents diverse opportunities, albeit with considerations. The digital age offers platforms for freelancing, online trading, and e-commerce, allowing individuals to leverage skills and creativity for financial gain. Cryptocurrency investments continue to allure with potential for quick profits, yet they entail high volatility and risk. Moreover, the rise of the gig economy enables flexible work arrangements through apps and websites, offering quick payouts but often without job security or benefits. Passive income streams such as rental properties and investments in stocks or bonds remain viable, but demand initial capital and ongoing management. Amid these options, caution is essential to avoid scams and unsustainable ventures promising overnight success. Ultimately, while the allure of easy money persists, informed decisions, diligence, and a long-term perspective are crucial for sustainable financial growth and security in the dynamic year ahead.